12+ charitable lead trust calculator

This calculator indicates the charitable income tax deduction available to donors making a current contribution to a currently offered us. The remainder factor multiplied by the funding amount equals the value of the charitable contribution.

How To Give To Charity In The Most Tax Effective Way

Deduction based on a 38 charitable midterm federal rate.

. The accumulated assets then go back to you or. Demo will receive a fixed contribution each year. Charitable Lead Annuity Trust.

For example if the remainder factor for a charitable remainder unitrust. The process for establishing a charitable lead trust is similar to establishing any other type of trust. The basic steps include.

For example if the remainder factor for a charitable remainder unitrust. The calculator illustrates the income and tax benefits to which you may be entitled if you establish a charitable lead trust to benefit the AACR Foundation. Please click the button below to open the calculator.

Wills Trusts and Annuities Home Why Leave a Gift. Legacy income trust trust and. Corpus Amount Donors Age Payout Rate 5 Rate 20 Payout Frequency.

The remainder factor multiplied by the funding amount equals the value of the charitable contribution. This is the total amount to loved ones based on the length of time. Local Estate Planning or Estate Settlement Representative.

The Institute for Justice will receive a fixed contribution. Your trust pays a fixed dollar amount each year to City of Hope for a term of years or one or more lifetimes. The calculator illustrates the income and tax benefits to which you may be entitled if you establish a charitable lead trust to benefit the AACR Foundation.

A charitable lead annuity trust is a perfect instrument to make a generous gift to demo while reducing or eliminating estate and gift taxes. 12 charitable lead trust calculator Friday October 21 2022 Charitable Lead Annuity Trust. Ways to Gift.

The charitable lead trust technique involves the creation of a trust that will make its initial payments to charity for a specified term of years or for a life or lives in being and which at the. This is a fixed amount that will not change from year to year. Please click the button below to open the calculator.

Charitable Lead Unitrust Calculator. Wills Trusts and Annuities. Charitable Lead Unit Trust CLUT Calculator - Single Life.

Charitable Lead Annuity Trusts CLATs Due to very low section 7520 and AFR rates now is an ideal time to consider creating and funding a Charitable Lead Annuity Trust. Professional Advisors Trustees. 3 Creating the trust on paper usually with the help.

Charitable Strat Death Benefit Long Term Gains Tax Avoided 112500 Income Tax Deduction 268719 Deduction Tax Savings 67180 Total After Tax Income 886599 Charitable Trust. Our Charitable Remainder Trust calculator will help you view the long-term tax benefits up-front tax deduction and additional investment returns you can earn with a trust. With respect to CLUTs.

A charitable lead annuity trust is a perfect instrument to make a generous gift to IJ while reducing or eliminating estate and gift taxes.

Form Defa14a East Resources Acquisiti

Charitable Lead Annuity Trust Calculator The Institute For Justice

Understanding Charitable Remainder Trusts

Raise Calculator Tool Scale Portal 2022

What Is The Take Home Salary For A Ctc Of 14 Lpa Quora

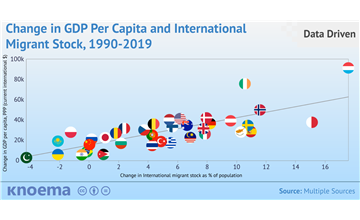

Free Infographics And Data Visualizations On Hot Topics Knoema Com

Founder S Journey Building A Startup From The Ground Up Podcast Podtail

Lenovo 300 Usb Keyboard Black Walmart Com

Charitable Remainder Trusts Uchicago Alumni Friends

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Charitable Lead Trusts Giving To Stanford

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Charitable Remainder Trust Calculator Crt Calculator

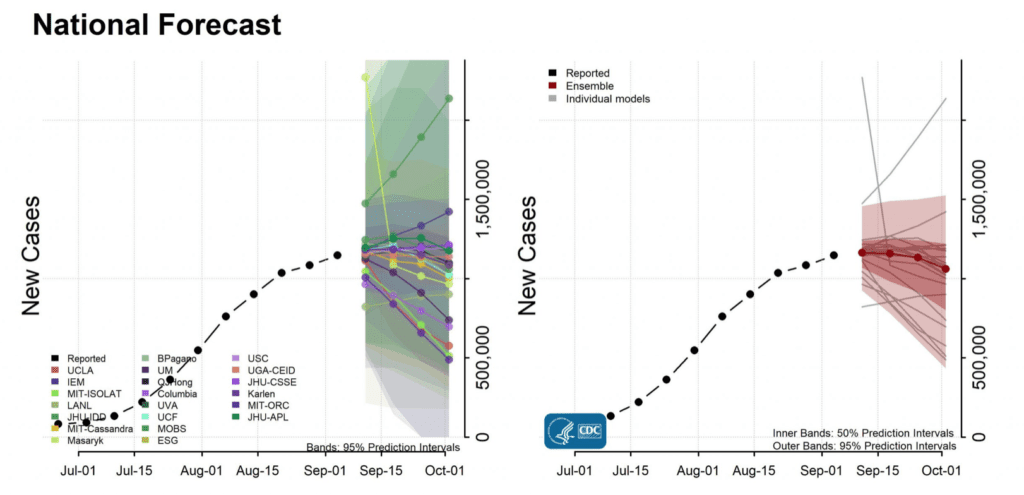

Wanna Bet A Covid 19 Example Statistical Modeling Causal Inference And Social Science

Charitable Remainder Trust Calculator Crt Calculator

I Have A Ctc Of Around 10 Lacs How Much Will I Get In Hand Salary Per Month How Do I Save Tax Quora